Historic Document

Remarks on Taxation (1909)

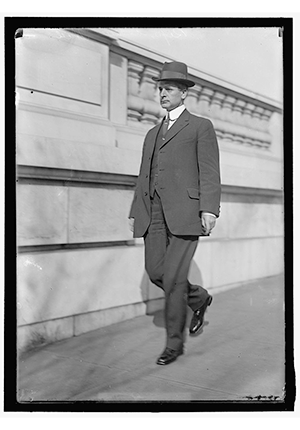

Cordell Hull | 1909

Library of Congress, Prints and Photographs Division, photograph by Harris & Ewing

Summary

In Pollock v. Farmers’ Loan and Trust Co. (1895), the Supreme Court struck down Congress’s attempt to impose a federal income tax through statute. The Court held that the Constitution forbade the imposition of a “direct” tax. The income tax was a progressive one, only taxing high incomes. So, it also stood condemned as “class legislation,” casting a special burden on the rich. Populists and populist-inclined Democrats in Congress pressed for Pollock to be overturned. Like the Court, the lawmakers’ arguments sounded in constitutional political economy. Representative Cordell Hull of Tennessee, one of the leading advocates of the income tax, argued in 1909 that “all authors of political economy of reputation” favor an income tax. Hull argued that to prohibit the government from taxing “accumulated wealth” amounted to special favoritism for the rich, while the consumption-focused tax system Pollock effectively required the government to employ what amounted to “an infamous system of class legislation.” Ultimately, the Sixteenth Amendment would allow the federal income taxes, but Hull’s constitutional arguments still echo in modern-day debates around taxing the nation’s wealthy.

Selected by

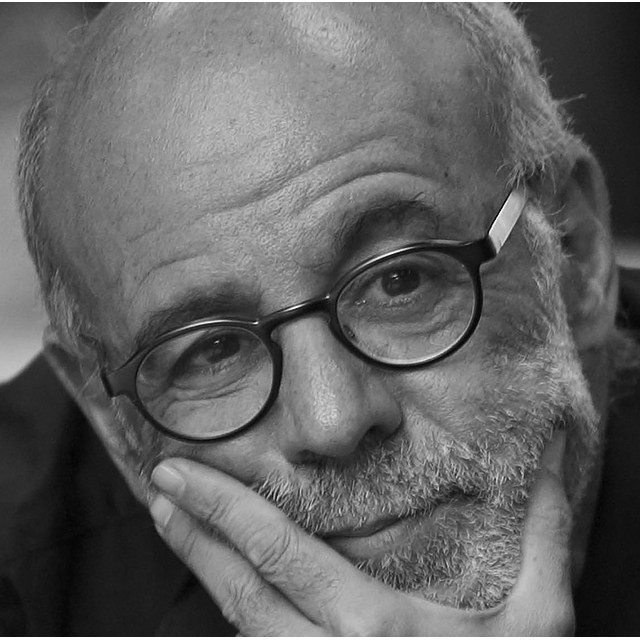

William E. Forbath

Lloyd M. Bentsen Chair in Law, and Associate Dean for Research, The University of Texas at Austin School of Law

Ken I. Kersch

Professor of Political Science, at Boston College

Document Excerpt

I desire in this connection to direct the attention of the House to the best, the fairest, the most equitable system of taxation that has yet been devised—the taxation of incomes. Adam Smith, the father of political economy, laid down this rule of taxation:

The subjects of every State ought to contribute toward the support of the Government as nearly as possible in proportion to their respective abilities—that is, in proportion to the revenue which they respectively enjoy under the protection of the States. . . .

I have no disposition to tax wealth unnecessarily or unjustly, but I do believe that the wealth of the country should bear its just share of the burden of taxation and that it should not be permitted to shirk that duty. Anyone at all familiar with the legislative history of the Nation must admit that the chief burdens of the government have long been borne by those least able to bear them, while accumulated wealth has enjoyed the protection and other blessings of the Government and thus far escaped most of its accompanying burdens. . . .

Heretofore any suggestion from this side of the House that our system of taxation should be so adjusted as to require the aggregated wealth of the country to bear a fair share of the burden of taxation has usually met the disapproval of the other side upon the ground that such course would be socialistic, if not unconstitutional. . . .

I agree that Members of Congress are under oath to support the Constitution, and that it is the duty of the Supreme Court, under proper circumstances, to construe and expound that instrument; but I submit that where, in the judgment of Members of Congress, a palpably erroneous decision has been rendered by the Supreme Court, stripping the coordinate legislative branch of the Government of one of its strong arms of power and duty—a decision overturning a line of decisions extending over a hundred years of the Nation’s history . . . . It is entirely proper that Congress should pass another income-tax act, again raising the important questions deemed to have been erroneously decided by the Supreme Court heretofore, and by this course secure a rehearing upon these controverted questions. . . .

The world has never seen such colossal fortunes as we behold in the present age. Their owners are richly able to pay taxes. Why does the Government, founded as it was upon the doctrine of equality, persist in taxing every article of necessity which the poor widow must buy, while it permits citizens residing in other countries to hold property here of probably $100,000,000 in value on which the Government declines to levy even a single cent of tax? . . . Public sentiment is becoming aroused. The American people are loudly, insistently demanding that this infamous system of class legislation shall cease, and unless this Congress regards their wishes they will soon compel compliance, even if they have to resort to a renovated Congress.