Historic Document

Letters from a Farmer in Pennsylvania, to the Inhabitants of the British Colonies (1768)

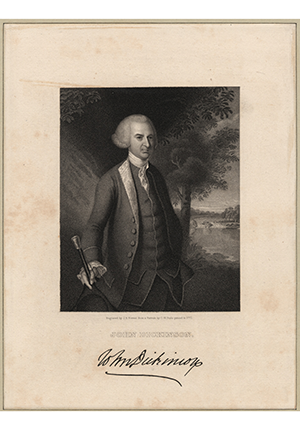

John Dickinson | 1768

Emmet Collection of Manuscripts Etc. Relating to American History, The New York Public Library

Summary

John Dickinson, a Pennsylvania lawyer, penned this series of essays to protest the Townshend Duties, a series of parliamentary taxes on imported luxury goods passed in the wake of the Stamp Act’s repeal. First serialized in newspapers, Dickinson’s essays circulated widely, and were later published in a single volume. Their appeal lay in their clarity—Dickinson did not say what others had not, he simply did so more cogently. The British government hoped that the Townshend Duties would be better received than the controversial Stamp Act on the theory that the former were external, not internal taxes. Dickinson rejected this distinction, insisting that the new duties violated American rights because, like the Stamp Act, their intent was to raise revenue. In collapsing the distinction between external and internal taxation, Dickinson helped push the colonists toward a general rejection of Parliamentary legislative authority.

Selected by

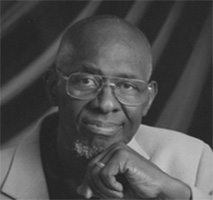

William B. Allen

Emeritus Dean of James Madison College and Emeritus Professor of Political Science at Michigan State University

Jonathan Gienapp

Associate Professor of History at Stanford University

Document Excerpt

There is another late act of parliament, which appears to me to be unconstitutional, and as destructive to the liberty of these colonies, as that mentioned in my last letter; that is, the act for granting the duties on paper, glass, etc.

The parliament unquestionably possesses a legal authority to regulate the trade of Great Britain, and all her colonies. Such an authority is essential to the relation between a mother country and her colonies; and necessary for the common good of all. He who considers these provinces as states distinct from the British Empire, has very slender notions of justice, or of their interests. We are but parts of a whole; and therefore there must exist a power somewhere, to preside, and preserve the connection in due order. This power is lodged in the parliament; and we are as much dependent on Great Britain, as a perfectly free people can be on another.

I have looked over every statute relating to these colonies, from their first settlement to this time; and I find every one of them founded on this principle, till the Stamp Act administration….Never did the British parliament, till the period above mentioned, think of imposing duties in America for the purpose of raising a revenue.

The last act, granting duties upon paper, etc. carefully pursues these modern precedents….Here we may observe an authority expressly claimed and exerted to impose duties on these colonies; not for the regulation of trade; not for the preservation or promotion of a mutually beneficial intercourse between the several constituent parts of the empire, heretofore the sole objects of parliamentary institutions; but for the single purpose of levying money upon us.

…

Here then, my dear countrymen, rouse yourselves, and behold the ruin hanging over your heads. If you ONCE admit, that Great Britain may lay duties upon her exportations to us, for the purpose of levying money on us only, she then will have nothing to do, but to lay those duties on the articles which she prohibits us to manufacture—and the tragedy of American liberty is finished.

…

The constitutional modes of obtaining relief are those which I wish to see pursued on the present occasion; that is, by petitions of our assemblies, or where they are not permitted to meet, of the people, to the powers that can afford us relief.

We have an excellent prince, in whose good dispositions toward us we may confide. We have a generous, sensible and humane nation, to whom we may apply. They may be deceived. They may, by artful men, be provoked to anger against us. I cannot believe they will be cruel and unjust; or that their anger will be implacable. Let us behave like dutiful children who have received unmerited blows from a beloved parent. Let us complain to our parent; but let our complaints speak at the same time the language of affliction and veneration.

If, however, it shall happen, by an unfortunate course of affairs, that our applications to his Majesty and the parliament for redress, prove ineffectual, let us then take another step, by withholding from Great Britain all the advantages she has been used to receive from us. Then let us try, if our ingenuity, industry, and frugality, will not give weight to our remonstrances. Let us all be united with one spirit, in one cause.

…

Some persons may think this act of no consequence, because the duties are so small. A fatal error. That is the very circumstance most alarming to me. For I am convinced, that the authors of this law would never have obtained an act to raise so trifling a sum as it must do, had they not intended by it to establish a precedent for future use. To console ourselves with the smallness of the duties, is to walk deliberately into the snare that is set for us, praising the neatness of the workmanship.

…

Those who are taxed without their own consent, expressed by themselves or their representatives, are slaves. We are taxed without our own consent, expressed by ourselves or our representatives. We are therefore—SLAVES.